G. Kalyan Kumar

The commercial real estate sector in India, particularly in the northern part is showing a steady boom. Surging investment inflows and booming construction activities have unleashed high demand for commercial spaces. The residential property market is also doing well and the demand has helped commercial real estate. India is already among the top 10 price-appreciating housing markets internationally.

Northern India covering Delhi, Haryana, Punjab, Rajasthan, Uttar Pradesh, and Uttarakhand have shown a significant demand growth in commercial and residential real estate. The trends are almost the same in East, West, and Southern regions as well.

The umbrella term commercial property refers to land and buildings used for business purposes and related operations. They include hotels, resorts, shopping malls, stores, office buildings, parking lots, and medical centers. Residential real estate makes spaces for individuals, families, or groups of people in terms of homes, apartments, condominiums, townhouses, and villas among others.

Industrial real estate includes land and buildings used for industrial businesses for factories, mechanical productions, research and development, construction, transportation, logistics, and warehousing.

Investment appetite growing

The average rate of return on a commercial property is high compared to residential ones. It takes into account several factors, including the cost of the property, the initial investment in making it ready for tenants, and the maintenance costs. The high ROI also entails a higher outgo of expenses and maintenance costs coming with ownership of commercial property.

Average rates of return can vary month-to-month and year-to-year, so the investor takes a larger view of the property market for the long term. The ROI on commercial property, according to experts, will not be uniform. While a low-performing property may have an ROI closer to 6 percent high performing property will be double or higher.

Government policies driving growth

The commercial real estate sector has got a considerable leg up from the Central government’s initiatives such as Make in India, Digital India, and Smart Cities. These initiatives have attracted domestic and foreign investors resulting in higher investments in commercial real estate projects.

Growth of the retail sector: There has been a drastic growth in the organized retail real estate that has now touched 82 million square feet. The rise of the organized retail sector will transform North India into one of the major retail hubs in the country. The growth of E-commerce has also accelerated the retail real estate segment in North India.

Top E-commerce companies like Amazon and Flipkart have established warehouses and distribution centers in many places boosting logistics and warehousing.

Demand for high-quality Office space

The commercial real estate sector is also witnessing a shift towards Grade A and Grade B office spaces. Grade A office spaces are in prime locations and boast modern amenities, while Grade B office spaces in emerging business districts carry moderate facilities. In Northern India, the growth of the IT and ITeS sectors has been a force multiplier in office space demand.

In the National Capital Region, thriving business districts such as Gurgaon, Noida, and Greater Noida with their IT and ITeS companies, MNCs, and world-class office spaces are at the forefront of feeding the demand for commercial real estate growth.

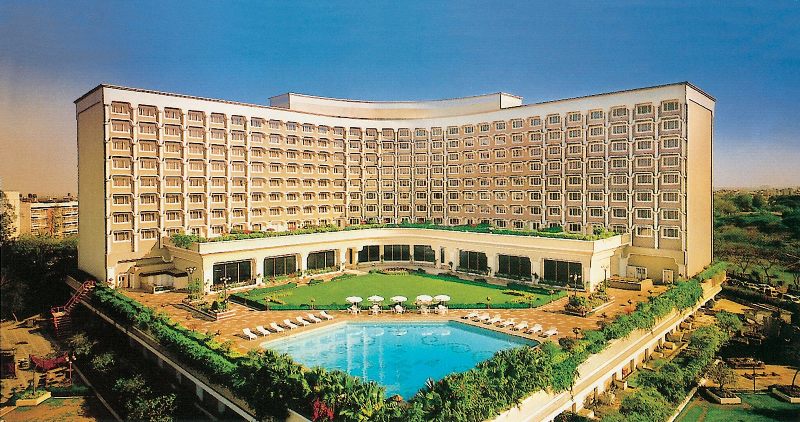

Rise of hospitality real estate

The hospitality real estate segment is witnessing huge growth in North India. The market includes popular tourist destinations such as Agra, Jaipur, and Shimla. They contribute significantly to the growth of the hospitality industry in India. The spurt in foreign tourist arrivals has made hospitality real estate a hot segment with a big jump in buy and sale deals.

Says Anita Sinha, a lawyer and a keen observer of the market dynamics in real estate: “A steep rise in property deals in the hospitality real estate covering resorts, hotels, and raw land is in sight in many northern states. It shows the viability of investing in commercial real estate both for immediate yields and resale in the medium and long term.”

India attractive for hotel investments

India has emerged as one of the hottest markets for global hotel chains evidenced by the opening of 150 new hotels in 2022 resulting in a total of 11,000 plus rooms. Marriott the world’s largest hotel chain is mulling that it will add 100 properties in India by 2025. Hilton Group is aiming to double the number of hotels in three years.

French hospitality group Accor is looking to develop the economy- and mid-scale brands in Tier-II and III cities through franchises. For premium brands, the company targets Tier-I and II cities under a management contract.

Advantages of investing in resorts

In the growth story of resorts Vs hotels in leisure destinations, is there a preference towards resorts as a viable business model?

In the hotel industry trends in terms of development, operation, and consumption resorts are emerging as a credible investment class, despite many limitations. The revenue model of resorts targets mainly domestic travelers. The growth rate is healthy as rising incomes have made more Indians enjoy travel and they find resorts more comfortable and affordable.

Resorts thriving in the FIT segment

In big hotels corporate and airline segments contribute close to 60 percent of the demand with attractive discounts. Resorts have only 25 percent of their accommodated demand from these elite groups and they have the largest share of room nights from the Free Independent Traveller (FIT) segment.

Also, resorts are easy to set up as the land cost never goes beyond 20 percent of the project cost. The benefit of lower per unit land cost is an advantage for resorts. Unlike resorts in emerging leisure destinations, city hotels need to plan 50 percent of their project cost towards land acquisition.

Resorts enjoy the benefits of low volumes- high rates, large volumes-low rates tariff plan. Resorts have adopted this business model in planning room rates under mass and premium perspectives. Occupancy rates are jumping with online hotel bookings, although it is still in the early phase. As a result, the standard 50 percent occupancy mark associated with the seasonality in top leisure markets has been breached. That is why you are seeing a huge surge in occupancy rates, such as Agra (60%), Jaipur (64%), and Goa (71%) in the lot.

Gross revenue per available room in resorts is higher than in city hotels. Resorts generate a better return on the cost they incur to acquire their customer. Resorts can raise cheaper capital from the market via deeded timeshares. A typical timeshare buyer will pay 1/52th share of a room for week-long ownership. Many resort owners have chosen to raise equity capital by allocating a third or more of their inventory toward timeshare arrangements.

Resort markets in Puducherry, Mount Abu, Coorg, Gangtok, and many others are waiting to zoom as flight connectivity expands. Well-sized resorts with 100+ rooms can recover high capex and other expenses with a larger inventory. But that needs deep markets.

The outlook on commercial property is bright as deals in the commercial real estate market are expected to pick up pace, according to Sandeep Sharma, head of the property consultancy Sharma Estates in New Delhi.