The Finance Minister of India, Ms Nirmala Sitharaman, presented the interim budget for 2024 months before the general elections expected in April and May. It was not a full-fledged budget, as the tenure of the government ends in a few months.

Contrary to the expectations of an overdose of pre-poll freebies and sops, the FM has sought to compile a somewhat balanced budget, juggling fiscal prudence and care for key constituencies with push for development that shall be driven by investment more than consumption.

The budget echoes the mottos Sabka Saath, Sabka Vikas, and Sabka Vishwas. It highlights key sections that are in focus, as reiterated by Prime Minister Narendra Modi: ‘Garib’ (poor), ‘Mahilayen’ (women), ‘Yuva’ (youth), and ‘Annadata (farmers).

GDP growth and Inflation challengeThe interim budget expects a 10.5 percent nominal growth in GDP after inflation in the period 2023–24 to 2024–25. However, the “real” rate of GDP growth is expected to be around 7 percent. This assumes an inflation rate of around 3.5 percent in the coming financial year. This can be an area of challenge as high inflation at a time of stagnant wages and an escalating cost of living drain household savings and impact consumption too.

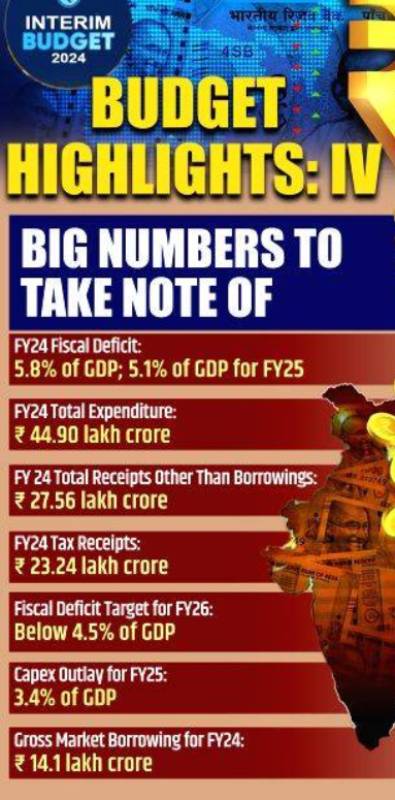

Fiscal PrudenceOn the fiscal deficit front, the FM aims to sharply reduce the budget gap to 5.1 percent of GDP in 2024–25, after revising the current fiscal’s previously estimated gap to 5.8 percent from the erstwhile 5.9 percent.

By asserting the agenda of investment-led growth, the budget is trying to send a message of confidence and reassurance to rating agencies in terms of better fiscal consolidation amid a bevy of global economies fighting off harsh headwinds.

PM Narendra Modi talks to media

PM Narendra Modi talks to media

S&P and Fitch have set India’s rating at BBB (Triple B), while Moody’s has accorded the rating Baa3. The budget’s adherence to calibrated control of the fiscal deficit sends a positive signal to investors about India's commitment to growth and fiscal responsibility.

Key ingredientsThe interim budget aims for a historic high in capital expenditure at INR 11.11 trillion ($133.90 billion). The major highlights of the budget are higher allocation for infrastructure capacities, viability funding for wind energy, mega railway corridors, new ports, including one at Lakshadweep, and a boost for urban infrastructure with more metro rail projects for transportation.

There is anticipation of higher capital expenditures. The government wants to involve a larger corpus of private investment along with working capital, and it expects this credit outflow will also jump. That will also unlock more employment opportunities.

Eyes on the July budgetGiven that the interim budget is more of a trailer to the main budget by a new government in July, This ‘vote on account' has refrained from populist sops or screaming policy pronouncements.

The tight fiscal consolidation is a precondition for sustainable future growth of the economy. Now all eyes are on the main budget expected in July, according to analysts.

Tax sops absentDespite expectations of some poll-eve relaxations in the income tax brackets, there had been no tinkering with tax slabs as the FM stuck to the status quo both in direct and indirect taxes.

However, a minor relief was the proposal to withdraw outstanding direct tax demands up to Rs 25,000 as a considerate approach towards individuals in lower income brackets.

The assurance of moderate tax liability for income up to Rs 7 lakh (0.7 million) demonstrates a commitment to easing the burden on middle-income individuals.

The existing slabs are under a new tax regime.

• Annual income up to INR 3 lakh: zero tax

• Annual income between INR 3 lakh and INR 6 lakh: 5%

• Annual income: INR 6 lakh; INR 9 lakh: 10%

• Annual income between INR 9 lakh and 2 lakh: 15%

• Annual income: INR 12 lakhs; INR 15 lakhs: 20%

• Annual income above INR 15 lakh: 30% tax

Business Chamber hails budgetAjay Singh, president of the business chamber ASSOCHAM, and CMD SpiceJet praised the budget. He described the budget as “India's first budget,” emanating from a confident government that is traversing to the objective of making India a $5 trillion economy by 2025 and a developed nation by 2047. The focus on clean energy, technology, and digital infrastructure will make India a leader among other growing economies.

Vande Bharat super fast train

Vande Bharat super fast train

Among budget plans, the real estate and housing sectors are likely to have a direct benefit from schemes seeking to support the middle class in acquiring or constructing homes. This is set to drive demand for residential properties and the expansion of the real estate sector.

The FM also announced a plan to construct an additional 2 crore (20 million) homes for the rural poor in the next five years.

Growth from Investment vs. ConsumptionThe budget pronouncements reflect the government’s road map to make economic growth more investment-led than consumption-driven.

This change in pattern is set to reverse the trend of the government taking on the bulk of the spending via borrowings. It has the risk of lopsided management of borrowings, aggravating the debt burden beyond the permissible limits of the GDP level.

To invite high-value private investments, higher capacity utilization is imperative. The need to find more avenues for revenue generation is also a challenge, beyond the beaten path of public sector disinvestment.

In the politics of wooing voters with subsidized electricity tariffs, the budget has found a healthy alternative. It has rolled out a constructive rooftop solarization and “muft bijli” plan to save energy costs.

Indian farmer in his farm land

Indian farmer in his farm land

According to the FM, 10 million households will get 300 units of free electricity every month through rooftop solarization. This will help each household save Rs. 15000 to Rs. 18000 annually.

Also, the expansion of healthcare coverage under Ayushman Bharat to cover all ASHA workers, Anganwadi workers, and helpers is a positive step.

Infrastructure PushOn the infrastructure front, the budget envisages three major economic railway corridor programs under PM, Gati Shakti, to improve logistics efficiency and reduce costs. They include 1. Energy, mineral, and cement corridors 2. Port connectivity corridors 3. High-traffic-density corridors

Also, 40,000 normal rail bogies will be converted to Vande Bharat standards. In the aviation sector, the number of airports will be doubled to 149.

The budget has earned accolades for its target for fiscal discipline and continuity in critical commitments made by the government on fiscal rectitude. Increased capital outlay in infrastructure and added investments in railways, aviation, etc. are aiming for a multiplier effect on the ground.